The adoption of 5G non-terrestrial networks (NTN) along with terrestrial 5G has the potential to revolutionise the telecom industry by creating a seamless network, unlocking new revenue streams for telcos, according to experts.

They added that the integration of NTN with terrestrial 5G could enable remote data services and maritime communications and will allow telecom service players to offer more reliable and high-quality services, ranging from ultra-low latency applications to high-bandwidth services.

Unlike traditional mobile towers that beam signals to mobile phones, the 5G NTN standard leverages satellites in orbit to transmit connectivity, including data, to handsets on earth. NTN is now a part of 3GPP Release-19 specifications for 5G. 3GPP is a global body which specifies telecommunications standards that are followed by telcos, chipmakers and handset providers.

Wait and watch

The demand for niche applications, like disaster management via satellite communications, will always remain as they address critical and specialised needs. However, the 5G NTN standard has the potential to unlock even more significant opportunities, particularly in the rapidly expanding internet of things (IoT) market, according to industry analysts.

“This will lead to the emergence of a wider variety of applications and use cases, creating added value for users in vertical markets. These advancements are expected to fuel significant growth in the global satellite communications market,” said Gareth Owen, associate director, Counterpoint Research. “By enabling seamless connectivity in remote and underserved regions, 5G NTN can help propel the growth of internet of things applications across industries, driving innovation and creating new possibilities on a global scale.”

However, despite the immense potential, it will take several years for this vision to fully come to fruition, Owen added.

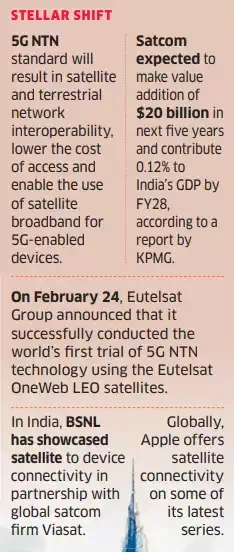

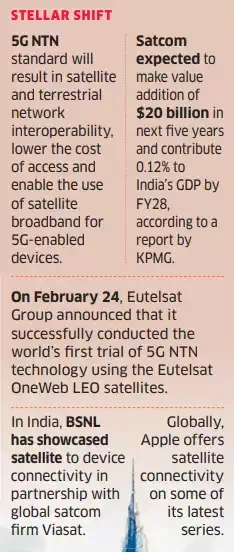

Satcom, on its part, is poised to make a value addition of $20 billion in the next five years and contribute 0.12% to India’s GDP by FY28, according to a report by KPMG. Experts said satcom is a very competitive and difficult market to be profitable in and there are too many systems chasing a limited market opportunity.

Historically, the satellite communications market has remained a niche sector, largely due to its reliance on proprietary technologies. However, the introduction of a standardised 5G NTN solution has the potential to significantly expand the addressable market for broadband-from-space services.

Satellite-to-device services a reality?

Bharat Sanchar Nigam Ltd (BSNL) recently showcased satellite-to-device connectivity in partnership with global satcom firm Viasat. The state-run operator’s direct-to-device satellite connectivity will offer emergency call capabilities, SOS messaging systems and UPI payment functionality in network-dark zones.

While satellite communication isn’t new globally — with companies like Apple already offering similar services on some of their latest series — BSNL’s initiative marks the first time such technology will be available to Indian consumers.

The Eutelsat Group, on February 24, announced it successfully conducted the world’s first trial of 5G NTN technology using the Eutelsat OneWeb LEO satellites. This paves the way for the development of the 5G NTN standard, which will result in satellite and terrestrial network interoperability, lower the cost of access and enable the use of satellite broadband for fifth-generation (5G)-enabled devices globally, the company said.

Earlier, satellite communications in India were restricted to emergency services and military operations. Currently in India, satellite communications are permitted primarily in the B2B sector and not the B2C sector.

The last mile connectivity from the VSAT (point of interconnection to the satellite) is through either a wired or wireless connection. B2C is allowed under special licences for disaster recovery and emergency operations. But this could change significantly in the next few years.

A leading telecom expert said 5G NTN will plug in gaps where traditional telecom players haven’t been able to offer internet connectivity services, expanding market reach for service providers.

“This [5G NTN] will open up new revenue streams, enable remote data services, maritime communications and will allow telecom service players to offer more reliable and high-quality services, ranging from ultra-low latency applications to high-bandwidth services. The industry will be able to unlock new market opportunities, improve service delivery and cater to a broader range of customers,” according to a telco executive.

Purushothaman KG, partner and head-digital solutions and national telecommunications leader at KPMG in India, said there are multiple use cases for satcom services, including facilitating five billion ATM transactions annually through 1,25,000 very small aperture terminal (VSAT)-enabled ATMs.

Additionally, it plays a crucial role in networking the nearly $2-trillion equity markets and provides support for cellular backhaul, enterprise networking, rural connectivity, as well as in-flight, rail and maritime communications.

Also, 50,000 gas stations are automated via satcom, which offer a reliable link to access information on a real-time basis. At least 65,000 trains are fitted with GAGAN (GPS-aided GEO augmented navigation) devices, which has improved efficiency in train operations to a significant extent, he said.

‘Economies of scale crucial’

Although tremendous progress has been made in reducing costs of satellites and launches over the past 20 years, satellite systems are still very expensive compared to terrestrial networks and have limited capacity, making it difficult to develop a profitable business case for consumer broadband access.

Owen adds that economics might work in geographically large, advanced economies such as the US, Canada or Australia, but the market size is not sufficient enough to support a major low-earth orbit (LEO) constellation, which is why companies like Starlink are trying to add as many other markets as possible, including India.

India’s leading telecom players, Mukesh Ambani’s Reliance Jio and Bharti Airtel helmed by billionaire Sunil Mittal, whose Bharti Global owns a stake in satellite internet company OneWeb, have plans to launch commercial satellite broadband services. The vast potential in India, which already has the most number of telecom and internet users outside China, has attracted a host of global players including Elon Musk’s Starlink, Amazon’s Kuiper and Canada’s Telesat in partnership with Tata Group’s Nelco.

There is a first-mover advantage for Starlink globally, which is good but not necessarily a deciding factor, as satellite markets are slow to develop and require substantial marketing investments, said analysts.

Jio has teamed up with SES-Astra, a well-established satellite operator, which is using medium earth orbit (MEO) satellites instead of LEOs. MEO requires fewer satellites and provides wider coverage with a smaller number of satellites enabling cost efficiency in the longer run. However, higher orbit satellites have higher latency, which is important to consider when combining satellites with 5G networks. SES’s MEO system’s latency is said to be compatible with 5G requirements, so it should not be a problem, according to Counterpoint.

As 5G services gain traction in India, it’s essential not to overlook the crucial role of satcom services, which will be the next major step in further enhancing connectivity across the country, Purushothaman added.

They added that the integration of NTN with terrestrial 5G could enable remote data services and maritime communications and will allow telecom service players to offer more reliable and high-quality services, ranging from ultra-low latency applications to high-bandwidth services.

Unlike traditional mobile towers that beam signals to mobile phones, the 5G NTN standard leverages satellites in orbit to transmit connectivity, including data, to handsets on earth. NTN is now a part of 3GPP Release-19 specifications for 5G. 3GPP is a global body which specifies telecommunications standards that are followed by telcos, chipmakers and handset providers.

Wait and watch

The demand for niche applications, like disaster management via satellite communications, will always remain as they address critical and specialised needs. However, the 5G NTN standard has the potential to unlock even more significant opportunities, particularly in the rapidly expanding internet of things (IoT) market, according to industry analysts.

“This will lead to the emergence of a wider variety of applications and use cases, creating added value for users in vertical markets. These advancements are expected to fuel significant growth in the global satellite communications market,” said Gareth Owen, associate director, Counterpoint Research. “By enabling seamless connectivity in remote and underserved regions, 5G NTN can help propel the growth of internet of things applications across industries, driving innovation and creating new possibilities on a global scale.”

However, despite the immense potential, it will take several years for this vision to fully come to fruition, Owen added.

Satcom, on its part, is poised to make a value addition of $20 billion in the next five years and contribute 0.12% to India’s GDP by FY28, according to a report by KPMG. Experts said satcom is a very competitive and difficult market to be profitable in and there are too many systems chasing a limited market opportunity.

Historically, the satellite communications market has remained a niche sector, largely due to its reliance on proprietary technologies. However, the introduction of a standardised 5G NTN solution has the potential to significantly expand the addressable market for broadband-from-space services.

Satellite-to-device services a reality?

Bharat Sanchar Nigam Ltd (BSNL) recently showcased satellite-to-device connectivity in partnership with global satcom firm Viasat. The state-run operator’s direct-to-device satellite connectivity will offer emergency call capabilities, SOS messaging systems and UPI payment functionality in network-dark zones.

While satellite communication isn’t new globally — with companies like Apple already offering similar services on some of their latest series — BSNL’s initiative marks the first time such technology will be available to Indian consumers.

The Eutelsat Group, on February 24, announced it successfully conducted the world’s first trial of 5G NTN technology using the Eutelsat OneWeb LEO satellites. This paves the way for the development of the 5G NTN standard, which will result in satellite and terrestrial network interoperability, lower the cost of access and enable the use of satellite broadband for fifth-generation (5G)-enabled devices globally, the company said.

Earlier, satellite communications in India were restricted to emergency services and military operations. Currently in India, satellite communications are permitted primarily in the B2B sector and not the B2C sector.

The last mile connectivity from the VSAT (point of interconnection to the satellite) is through either a wired or wireless connection. B2C is allowed under special licences for disaster recovery and emergency operations. But this could change significantly in the next few years.

A leading telecom expert said 5G NTN will plug in gaps where traditional telecom players haven’t been able to offer internet connectivity services, expanding market reach for service providers.

“This [5G NTN] will open up new revenue streams, enable remote data services, maritime communications and will allow telecom service players to offer more reliable and high-quality services, ranging from ultra-low latency applications to high-bandwidth services. The industry will be able to unlock new market opportunities, improve service delivery and cater to a broader range of customers,” according to a telco executive.

Purushothaman KG, partner and head-digital solutions and national telecommunications leader at KPMG in India, said there are multiple use cases for satcom services, including facilitating five billion ATM transactions annually through 1,25,000 very small aperture terminal (VSAT)-enabled ATMs.

Additionally, it plays a crucial role in networking the nearly $2-trillion equity markets and provides support for cellular backhaul, enterprise networking, rural connectivity, as well as in-flight, rail and maritime communications.

Also, 50,000 gas stations are automated via satcom, which offer a reliable link to access information on a real-time basis. At least 65,000 trains are fitted with GAGAN (GPS-aided GEO augmented navigation) devices, which has improved efficiency in train operations to a significant extent, he said.

‘Economies of scale crucial’

Although tremendous progress has been made in reducing costs of satellites and launches over the past 20 years, satellite systems are still very expensive compared to terrestrial networks and have limited capacity, making it difficult to develop a profitable business case for consumer broadband access.

Owen adds that economics might work in geographically large, advanced economies such as the US, Canada or Australia, but the market size is not sufficient enough to support a major low-earth orbit (LEO) constellation, which is why companies like Starlink are trying to add as many other markets as possible, including India.

India’s leading telecom players, Mukesh Ambani’s Reliance Jio and Bharti Airtel helmed by billionaire Sunil Mittal, whose Bharti Global owns a stake in satellite internet company OneWeb, have plans to launch commercial satellite broadband services. The vast potential in India, which already has the most number of telecom and internet users outside China, has attracted a host of global players including Elon Musk’s Starlink, Amazon’s Kuiper and Canada’s Telesat in partnership with Tata Group’s Nelco.

There is a first-mover advantage for Starlink globally, which is good but not necessarily a deciding factor, as satellite markets are slow to develop and require substantial marketing investments, said analysts.

Jio has teamed up with SES-Astra, a well-established satellite operator, which is using medium earth orbit (MEO) satellites instead of LEOs. MEO requires fewer satellites and provides wider coverage with a smaller number of satellites enabling cost efficiency in the longer run. However, higher orbit satellites have higher latency, which is important to consider when combining satellites with 5G networks. SES’s MEO system’s latency is said to be compatible with 5G requirements, so it should not be a problem, according to Counterpoint.

As 5G services gain traction in India, it’s essential not to overlook the crucial role of satcom services, which will be the next major step in further enhancing connectivity across the country, Purushothaman added.