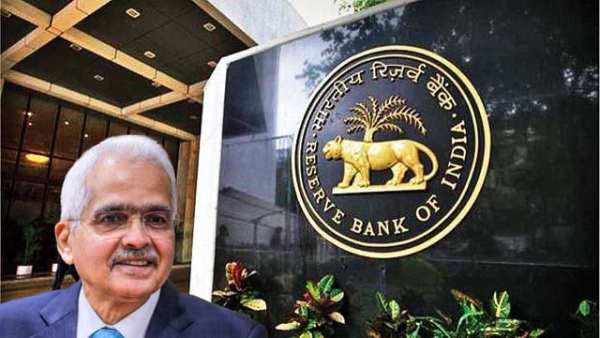

RBI Monetary Policy Meeting: The Reserve Bank of India (RBI) has released the schedule of meetings of the Monetary Policy Committee (MPC) for FY 2025-26. In the next financial year, the MPC will hold a total of 6 meetings, the first of which will be held on 7-9 April.

Also read this: RBI fined 75 lakhs on HDFC and 68 lakhs on PNB, know why you have to pay fine…

Complete calendar of MPC meetings

- First meeting: 7 to 9 April 2025

- Second meeting: 4 to 6 June 2025

- Third meeting: 5 to 7 August 2025

- Fourth meeting: 29 September to 1 October 2025

- Fifth meeting: 3 to 5 December 2025

- Sixth meeting: 4 to 6 February 2026

What is Monetary Policy Committee? (RBI Monetary Policy Meeting)

The monetary policy committee consists of 6 members, out of which 3 are from RBI, while the rest are appointed by the central government. The work of the committee is to set major interest rates in addition to formulating monetary policy to ensure price stability.

The repo rate, which determines the borrowings and deposit rates of banks, is fixed during the meeting of MPC. These meetings are usually held every two months. Dual and economic conditions are announced after discussion on the bilateral monetary policy.

The decisions of MPC are important in helping the government to keep the currency in a stable position and control inflation.

Current MPC member (RBI Monetary Policy Meeting)

- RBI Governor Sanjay Malhotra

- RBI Executive Director Dr. Rajiv Ranjan

- RBI Deputy Governor M Rajeshwar Rao

- Dr. Nagesh Kumar, Director and Chief Executive, Institute of Industrial Development Studies, New Delhi

- Sugata Bhattacharya, Economist

- Professor Ram Singh, Director, Delhi School of Economics, University of Delhi

Interest rate was cut in February (RBI Monetary Policy Meeting)

Earlier, in the last meeting of the current financial year i.e. 2024-25, RBI had cut interest rates by 0.25%. In the meeting held in February, the interest rates were reduced from 6.5% to 6.25%. This deduction was done after about 5 years.