As the new financial year (FY 2025-26) begins, several key changes are set to take effect from April 1, 2025. These changes will impact tax rules, banking, UPI transactions, GST, motor insurance, loans, toll tax, and daily expenses. Understanding these updates is crucial to plan your finances wisely.

🔹 Under the new tax regime, annual income up to ₹12 lakh will be tax-free.

🔹 Salaried employees will get a standard deduction of ₹75,000, reducing their taxable income.

🔹 A relief for the middle-class, as they will pay less tax.

🔹 Inactive mobile numbers linked to UPI IDs will be deactivated.

🔹 If your bank-registered number is inactive, update it before April 1, or your UPI payments may stop.

🔹 SBI, PNB, and Canara Bank are increasing their minimum balance requirements.

🔹 Failure to maintain the required balance will attract penalty charges.

🔹 For cheques above ₹50,000, customers must use the Positive Pay System (PPS).

🔹 Banks will require electronic confirmation before processing high-value cheques.

🔹 Reduces fraud risk and ensures safe transactions.

🔹 SBI, IDFC First Bank, and Axis Bank are changing their credit card reward and fee structure.

🔹 Some benefits may be reduced, and new charges might be introduced.

🔹 Government to launch UPS under NPS for central employees.

🔹 Employees with 25+ years of service will get 50% of their last 12 months’ average salary as a pension.

🔹 Multi-factor authentication (MFA) will be mandatory for GST login.

🔹 E-way bills can only be generated for documents within 180 days.

🔹 Business owners must complete biometric verification for GST registration.

🔹 LPG cylinder prices may increase or decrease based on government decisions.

🔹 Consumers should check new prices from April 1.

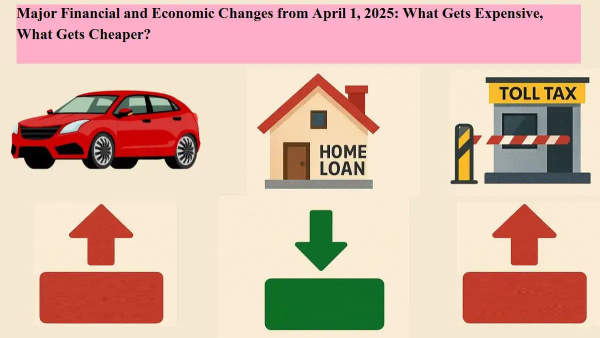

🔹 RBI’s new priority sector lending (PSL) rules may lead to lower home loan interest rates.

🔹 Easier access to affordable home loans for middle-class buyers.

🔹 Third-party car/bike insurance will get 15-20% costlier.

🔹 If you haven’t renewed your insurance, do it before April 1 to avoid higher premiums.

🔹 Maruti Suzuki, Hyundai, Tata Motors, Mahindra & Mahindra, Renault, and Kia to increase car prices by 2-3%.

🔹 Due to higher input costs and regulatory changes.

🔹 If you send money for overseas education, you won’t pay TDS on transfers up to ₹10 lakh.

🔹 Earlier, 5% TDS was applicable on transfers above ₹7 lakh.

🔹 No tax on rental income up to ₹6 lakh per year.

🔹 A relief for small landlords.

🔹 NHAI to increase toll charges on national highways and expressways.

🔹 Charges will depend on vehicle type and route.

🔹 Maharashtra government has made FASTag mandatory for all vehicles.

🔹 Non-FASTag vehicles will pay double the toll.

🔹 Uttar Pradesh to eliminate ₹10,000-₹25,000 physical stamp papers.

🔹 E-stamping will become mandatory.

✅ Biggest relief: Tax exemption up to ₹12 lakh, cheaper home loans, no TDS on education transfers.

❌ Biggest price hikes: Car prices, toll tax, LPG, third-party insurance, and credit card fees.

📢 Action required: Update UPI-linked numbers, check new bank rules, renew car insurance, and plan high-value transactions accordingly.

These changes will impact every citizen, from salaried employees to business owners and vehicle owners. Stay informed and plan accordingly!