Dream11 has returned to the Indian shores. Caught between GST woes and a potentially long tax bill, Dream11 has leveraged the government’s fast-track reverse flip mechanism to relocate from the US to India.

Why The Flip? The move would help it reduce compliances, simplify overall group structure, trim costs to inter-company transactions and bring efficiency to its operations. However, Dream11 could also be looking to list on the Indian bourses, having pulled back from its $1.5 Bn US listing three years ago.

A Not-So-Cushy Return: Moving back to India could cost Dream11 a fortune, as it could be staring at a hefty tax bill. For context, PhonePe paid INR 8,000 Cr while Groww shelled out INR 1,340 Cr to move their base back to India. However, it is difficult to ascertain the blow Dream11 may have to endure.

Not Enough: Adding to the challenge are tax notices totalling INR 40,000 Cr, which the company accumulated between 2017 and June 2022, on account of the 28% GST regime that came into effect in October 2023.

While Dream11 has yet to release its FY24 numbers, it crossed the INR 6K revenue mark in FY23 and posted a 32% YoY increase in its net profit to INR 187.83 Cr.

However, its top line could shrink in the ongoing fiscal as GST woes loom large. According to a reportrevenues of fantasy sports platforms are expected to take a 10% YoY hit in FY25 due to the steep tax structure plaguing the industry.

But, the gaming startup’s spirit looks steadfast, as Dream11 takes the speed lane to complete “Ghar Wapsi”.

Shadowfax Gears Up For IPO: The logistics startup has converted into a public entity, ahead of its proposed public listing. Shadowfax is said to be eyeing an INR 3,000 Cr IPO at a valuation of up to INR 8,000 Cr.

Ola Electric To Charge Up Battery Arm: The EV maker’s board has approved the infusion of INR 199 Cr in Ola Cell Technologies. The board has also okayed a proposal to convert outstanding payables worth INR 250 Cr of Ola Electric Technologies into 25 Cr CCPS.

Hood Pivots To Matchmaking: The social media platform has pivoted to the new business model under a new name ‘Knot.dating’. The “invite-only matrimonial service” built for India’s top-earning singles claims to use the “goodness of AI” to match people.

Foxconn Doubles Down On India: The contract manufacturer is looking to double the production of iPhones at its Indian units to 25-30 Mn units by 2025-end. Foxconn has been experimenting with restricted testing operations at its Bengaluru unit for the last few months.

OfBusiness’ AI Moat: The B2B ecommerce platform’s AI push, in the form of Nexizo, has come at a time when the company is gearing up for a $1 Bn IPO, likely in the second half of 2025. But, what is OfBusiness up to when it comes to AI adoption?

PlanetSpark’s Path To Profitability: While most Indian edtech startups have been stuck in a spiral of layoffs and shutdowns, the Binny Bansal-backed startup is scripting a rare turnaround story and claims to have turned cash flow positive in FY25.

BharatPe Enters The Breakeven Zone: BharatPe is finally on track to profitability and broke even on an adjusted EBITDA level in the first nine months of FY25. Can the fintech unicorn sustain the momentum ahead of its planned IPO?

Tracking India’s Startup IPO Spring: While 2024 was a blockbuster year for Indian startup listings, the momentum has continued well into 2025 as well. As many as 23 startups are in various stages of their IPO preparations while many others are lining up plans for a listing.

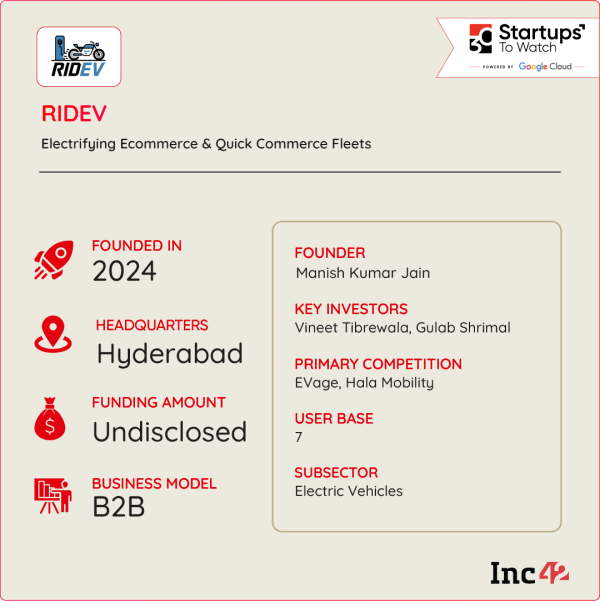

Quick commerce has made ultra-fast deliveries the norm, but it comes with a high environmental cost. India’s last-mile delivery sector alone could generate 8 Mn tonnes of carbon dioxide emissions by 2030. This is where RIDEV steps in.

Tackling Last-Mile Carbon Clutter: The cleantech startup is helping ecommerce and quick commerce companies go electric, minus the high upfront costs. Instead of buying EVs, businesses can lease electric two-wheelers from RIDEV, making the transition smooth and affordable.

In just six months, RIDEV has deployed over 4,000 EVs across major cities like Hyderabad, Mumbai, and Bengaluru. It has already onboarded big names like Tata BigBasket, PharmEasy, Licious, and Amazon.

Why The EV Leasing Model? The model makes sense for quick commerce platforms as they do not have to splurge heavily on acquiring EVs and can continue to function on an asset-light model. On the other hand, it means a steady stream of customers and revenue for RIDEV.

As India’s EV market heats up, can RIDEV carve out a scalable revenue stream?