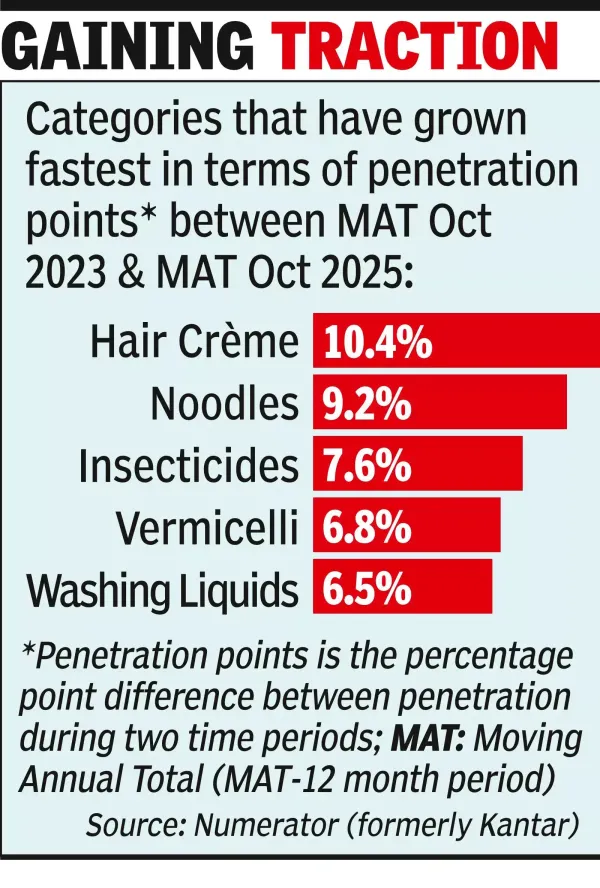

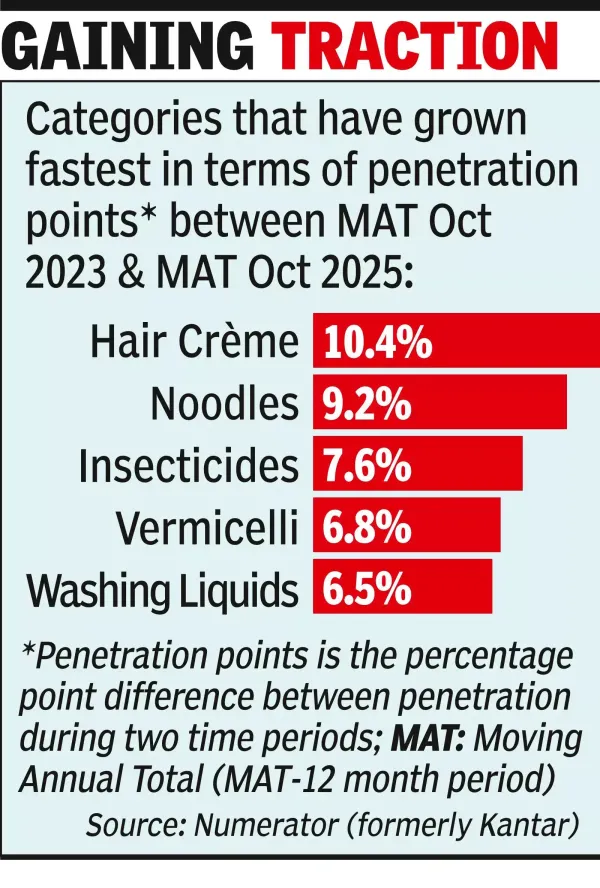

NEW DELHI: India’s consumption basket is shifting as newer categories enter more households, reshaping FMCG demand beyond traditional staples. Hair creme has emerged as the fastest-growing category by penetration, now used by nearly one-third of Indian consumers, according to the latest data from market research firm Numerator (formerly Kantar).

Household penetration for hair cream has jumped from 21% to over 31% in just two years.

Noodles have also made a strong comeback, adding nine percentage points in penetration over the same period to reach 77%, making them the second-fastest growing category. Vermicelli, a close substitute, has seen steady gains as well, with penetration rising by nearly seven percentage points to 39%.

"The overarching theme across the growth of these categories seems to be convenience - hair creme is an easily applicable and a less messy format of hair colours. Noodles and Vermicelli are also quick and convenient preparations. Washing liquids are likewise less messy and easier to use. Insecticides growth could be linked to the growing awareness of health and hygiene behaviours in the country," K Ramakrishnan, managing director-South Asia, Worldpanel by Numerator told Times of India.

The shifting consumption pattern is reflected in company disclosures. Godrej Consumer has flagged strong growth in hair creme and household insecticides, with revenue growth in hair colour accelerating to 24% in FY24 from a 16% compound annual growth rate between FY18 and FY23.

In packaged foods, India has emerged as Nestlé’s largest noodles market, with Maggi clocking about six billion servings in 2023-24, the company said in its annual report.

The trend marks a gradual diversification of India’s FMCG basket, which has traditionally been dominated by staples such as biscuits, tea, salt, toothpaste and edible oil, as convenience-led and grooming categories gain wider acceptance across households. (With inpurs from TOI)

Household penetration for hair cream has jumped from 21% to over 31% in just two years.

Noodles have also made a strong comeback, adding nine percentage points in penetration over the same period to reach 77%, making them the second-fastest growing category. Vermicelli, a close substitute, has seen steady gains as well, with penetration rising by nearly seven percentage points to 39%.

"The overarching theme across the growth of these categories seems to be convenience - hair creme is an easily applicable and a less messy format of hair colours. Noodles and Vermicelli are also quick and convenient preparations. Washing liquids are likewise less messy and easier to use. Insecticides growth could be linked to the growing awareness of health and hygiene behaviours in the country," K Ramakrishnan, managing director-South Asia, Worldpanel by Numerator told Times of India.

The shifting consumption pattern is reflected in company disclosures. Godrej Consumer has flagged strong growth in hair creme and household insecticides, with revenue growth in hair colour accelerating to 24% in FY24 from a 16% compound annual growth rate between FY18 and FY23.

In packaged foods, India has emerged as Nestlé’s largest noodles market, with Maggi clocking about six billion servings in 2023-24, the company said in its annual report.

The trend marks a gradual diversification of India’s FMCG basket, which has traditionally been dominated by staples such as biscuits, tea, salt, toothpaste and edible oil, as convenience-led and grooming categories gain wider acceptance across households. (With inpurs from TOI)