Grail Inc. (GRAL) stock remains in the spotlight after two Wall Street firms trimmed their price targets following disappointing data from a key U.K. study, even as both maintained bullish ratings.

On Thursday, the company announced that its study of the Galleri blood test, used for yearly multi-cancer screening in England’s National Health Service, failed to achieve its main goal.

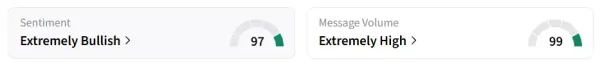

Grail stock traded over 42% lower in Friday’s premarket. However, on Stocktwits, retail sentiment around the stock changed to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘extremely high’ message volume levels.

The outcome prompted analysts to revisit their financial assumptions and adjust expectations for the blood-based cancer screening test developer. Baird analyst Catherine Ramsey Schulte slashed the price target on Grail to $82 from $113 while reiterating an ‘Outperform’ rating, according to TheFly.

Canaccord also lowered its price objective, cutting it to $80 from $105, while keeping a ‘Buy’ rating in place.

Schulte said Baird updated its financial model to reflect the trial outcome but stopped short of downgrading the stock, signaling continued confidence in Grail’s long-term commercial prospects despite the setback.

Canaccord acknowledged disappointment over the topline findings from the NHS-Galleri study and conceded that the regulatory and commercial path ahead may now appear less predictable.

Still, the firm said that the steep after-hours drop, which approached 50%, is an ‘overreaction’. Canaccord said it continues to view the broader data set from the U.K. initiative constructively, even though the study did not achieve its principal goal.

GRAL stock has gained over 112% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<