Continuing its dominance in the UPI ecosystem, fintech major PhonePe processed 810.2 Cr transactions in January 2025. This was 1.5% higher than the 798.4 Cr transactions processed in December 2024.

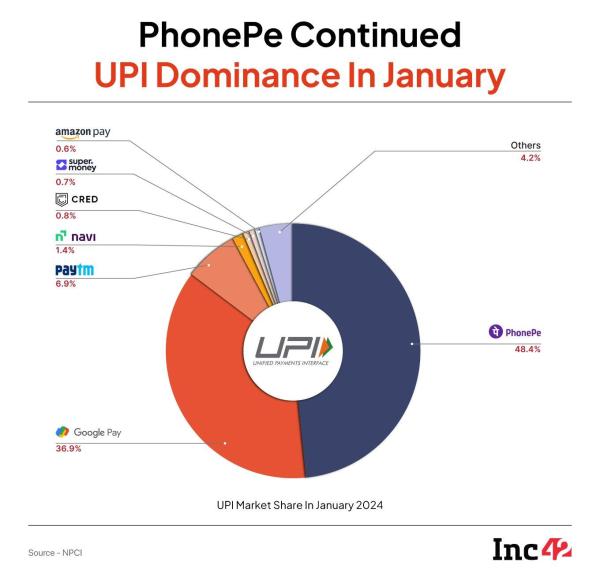

The fintech giant accounted for more than 48% of the total UPI transactions in January. The total value of the transactions processed by PhonePe stood at INR 11.91 Lakh Cr last month as against 11.76 Lakh Cr in December 2024.

Overall, UPI transactions touched an all-time high at 1,699 Cr in January, with total value of transactions at INR 23.84 Lakh Cr. The transaction count rose 1.5% month-on-month (MoM) and 39% year-on-year (YoY).

Google Pay held on to the second position last month with a market share of36.91%. Google’s fintech arm recorded 618.3 Cr transactions during the month under review, up 0.65% MoM.

Vijay Shekhar Sharma-led Paytm retained the third position, but its market share continued to decline. Paytm’s share in UPI transactions dipped to 6.87% in January from 6.97% in December 2024 and 7.03% in November 2024.

Sachin Bansal-led Navi continued to be at the fourth position, with its UPI transactions jumping nearly 20% to 24.28 Cr in January from 20.25 Cr in December 2024.

Meanwhile, Kunal Shah-led CRED marginally lost its market share after seeing a 3.9% decline in the transactions processed by it to 13.7 Cr as against 14.3 Cr in December.

This comes at a time when UPI ecosystem continues to expand and the payment technology has become synonymous with digital payments. As per a recent report by the Reserve Bank Of India (RBI), , with over 85% share in terms of volume. As per the report, out of 20,787 Cr digital payments recorded during the year, 17,221 Cr transactions were routed through UPI.

In 2024, the central bank increased the transaction limit of UPI Lite wallet to INR 5,000 from INR 2,000 to give a further push to UPI transactions. The offline transaction limit for UPI Lite service was also increased to INR 1,000 per transaction from INR 500.

Besides the growth in India, the National Payments Corporation of India (NPCI), which operates UPI, has taken a number of steps to take UPI global. For instance, last month, the provider Magnati to expand QR based UPI merchant payments in the UAE.

Later that month, the payment authority with an ID containing a special character to standardise the UPI ID generation process. The order was effective from February 1.

Acknowledging the rise of UPI, President Droupadi Murmu global recognition.

The post appeared first on .