Dream Sports, parent of fantasy gaming platform Dream11, has shifted domicile from Delaware, US, to India through the reverse merger route in a quiet move concluded recently.

Dream Sports Inc merged with Mumbai-based arm Sporta Technologies. A company spokesperson confirmed the development to ET. “Dream Sports is leveraging tech to unlock the massive potential of India’s sports ecosystem. We have completed ghar waapsi and are now an India-domiciled business,” the person said.

This is among the first examples of a new-age firm using the fast-track mechanism for cross-border mergers, under which a foreign holding entity can merge with its Indian subsidiary without clearance from the National Company Law Tribunal (NCLT).

Consolidation & cost savings

Under the fast-track route, implemented by the Centre in September 2024, companies can seek the approval of the regional director of the ministry of corporate affairs and bypass the NCLT process, which typically takes months to close.

In a filing made with the ministry, the Tiger Global-backed Dream11 said it was undertaking the reverse flip to “achieve cost savings from more focused operational efforts, lead to consolidation of the group and elimination of inter-company transactions,” among other reasons.

Dream11 has also secured Reserve Bank of India (RBI) approval as part of the process.

Tax woes

Online gaming companies face a goods and services tax (GST) demand of over Rs 1.1 lakh crore, including those slapped on retrospectively. Companies have challenged these notices in the Supreme Court, which has stayed the demand as an interim measure.

The internet sports firm said their bottom lines have been hit by 60-80% because of the change of the GST regime in 2023 that imposed the levy on the contest entry amount, instead of the platform fee.

Online gaming companies offer products such as fantasy sports and digital card games like rummy.

Dream Sports, which faces a GST demand of more than Rs 28,000 crore, had reported a 32% increase in net profit and a 66% jump in operating revenue for FY23. It hasn’t yet filed its financial statements for FY24, during which it would have recorded the impact of the increased tax outgo. Dream Sports is likely to see a hit of more than 60% to its profit base as it has not passed the tax burden on to users, according to people in the know.

Auditor SR Batliboi & Co noted in its FY23 financial statements that the demand over past dues “may cast significant doubt on (the) group’s ability to continue as a going concern.”

A ‘going concern’ is an entity that has sufficient resources available to continue making money and avoid the risk of bankruptcy for the foreseeable future.

Following the GST Council’s decision in 2023, Dream Sports began consolidating its business and shuttered its corporate investment arm Dream Capital, which had earlier been allocated a corpus of $250 million.

Jay Parikh, partner at Cyril Amarchand Mangaldas, said, "Despite the possibility of high tax incidence, many startups are looking to reverse flip due to favourable stock markets, economic outlook and general investor confidence in the Indian startup ecosystem.”

He added that the bypassing the time-consuming NCLT route helps to simplify the process and is a further boost to flipbacks.

In a November 2023 interview, Dream Sports cofounder and chief executive Harsh Jain said the company will make strategic bets on sports and allied sectors such as sports commerce, content, experiences, fitness and healthtech to broaden its revenue pool.

He said it is also bulking up its inhouse corporate development team to back startups at growth stages, moving away from its early-stage investing focus via the disbanded corporate venture arm.

Homecoming

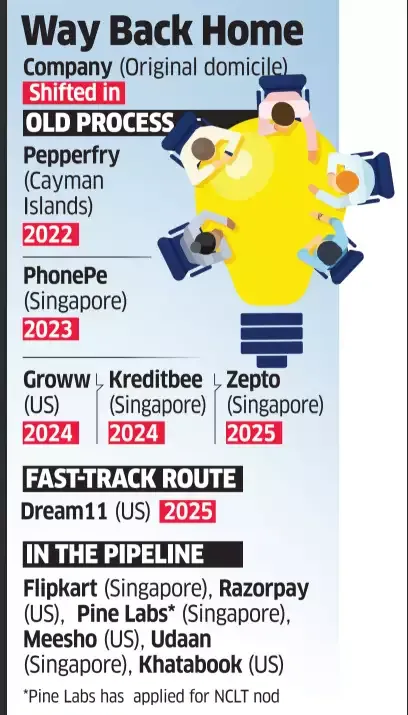

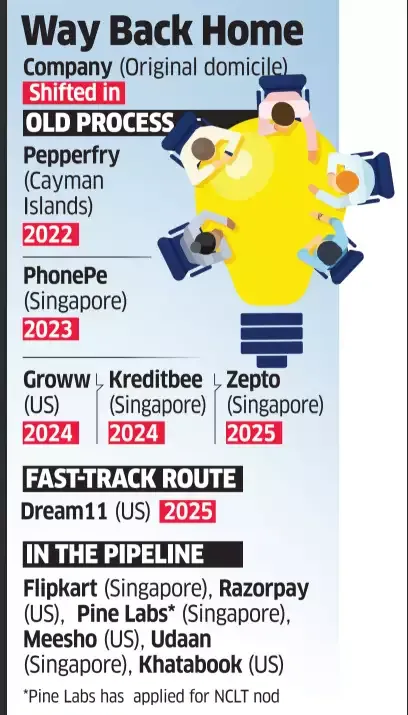

Founded by Jain and Bhavit Sheth in 2008, Dream Sports joins a long line of startups changing domicile. Large internet firms including PhonePe, Groww, Kreditbee and Zepto have already shifted, while the likes of Razorpay, Meesho and Pine Labs are in the queue to make the same move. Others such as Khatabook, Eruditus and Udaan are also considering similar plans.

ET reported on December 9 that India’s largest ecommerce firm, Flipkart, which is preparing for a public offering in the coming year, has secured internal approvals to move its domicile from Singapore to India.

Most of these companies are looking to tap the local market, which had offered rich valuations to startups until the recent correction. For fintech firms, shifting is helpful amid tighter regulations over the past few years for the overall space, as sector regulators are asking for companies and their subsidiaries to be registered locally.

In the case of Dream Sports, however, people in the know said there were no imminent plans for a public offering. In 2021, Dream Sports had already considered a US public listing through the special purpose acquisition company, but these plans did not materialise.

Dream Sports Inc merged with Mumbai-based arm Sporta Technologies. A company spokesperson confirmed the development to ET. “Dream Sports is leveraging tech to unlock the massive potential of India’s sports ecosystem. We have completed ghar waapsi and are now an India-domiciled business,” the person said.

This is among the first examples of a new-age firm using the fast-track mechanism for cross-border mergers, under which a foreign holding entity can merge with its Indian subsidiary without clearance from the National Company Law Tribunal (NCLT).

Consolidation & cost savings

Under the fast-track route, implemented by the Centre in September 2024, companies can seek the approval of the regional director of the ministry of corporate affairs and bypass the NCLT process, which typically takes months to close.

In a filing made with the ministry, the Tiger Global-backed Dream11 said it was undertaking the reverse flip to “achieve cost savings from more focused operational efforts, lead to consolidation of the group and elimination of inter-company transactions,” among other reasons.

Dream11 has also secured Reserve Bank of India (RBI) approval as part of the process.

Tax woes

Online gaming companies face a goods and services tax (GST) demand of over Rs 1.1 lakh crore, including those slapped on retrospectively. Companies have challenged these notices in the Supreme Court, which has stayed the demand as an interim measure.

The internet sports firm said their bottom lines have been hit by 60-80% because of the change of the GST regime in 2023 that imposed the levy on the contest entry amount, instead of the platform fee.

Online gaming companies offer products such as fantasy sports and digital card games like rummy.

Dream Sports, which faces a GST demand of more than Rs 28,000 crore, had reported a 32% increase in net profit and a 66% jump in operating revenue for FY23. It hasn’t yet filed its financial statements for FY24, during which it would have recorded the impact of the increased tax outgo. Dream Sports is likely to see a hit of more than 60% to its profit base as it has not passed the tax burden on to users, according to people in the know.

Auditor SR Batliboi & Co noted in its FY23 financial statements that the demand over past dues “may cast significant doubt on (the) group’s ability to continue as a going concern.”

A ‘going concern’ is an entity that has sufficient resources available to continue making money and avoid the risk of bankruptcy for the foreseeable future.

Following the GST Council’s decision in 2023, Dream Sports began consolidating its business and shuttered its corporate investment arm Dream Capital, which had earlier been allocated a corpus of $250 million.

Jay Parikh, partner at Cyril Amarchand Mangaldas, said, "Despite the possibility of high tax incidence, many startups are looking to reverse flip due to favourable stock markets, economic outlook and general investor confidence in the Indian startup ecosystem.”

He added that the bypassing the time-consuming NCLT route helps to simplify the process and is a further boost to flipbacks.

In a November 2023 interview, Dream Sports cofounder and chief executive Harsh Jain said the company will make strategic bets on sports and allied sectors such as sports commerce, content, experiences, fitness and healthtech to broaden its revenue pool.

He said it is also bulking up its inhouse corporate development team to back startups at growth stages, moving away from its early-stage investing focus via the disbanded corporate venture arm.

Homecoming

Founded by Jain and Bhavit Sheth in 2008, Dream Sports joins a long line of startups changing domicile. Large internet firms including PhonePe, Groww, Kreditbee and Zepto have already shifted, while the likes of Razorpay, Meesho and Pine Labs are in the queue to make the same move. Others such as Khatabook, Eruditus and Udaan are also considering similar plans.

ET reported on December 9 that India’s largest ecommerce firm, Flipkart, which is preparing for a public offering in the coming year, has secured internal approvals to move its domicile from Singapore to India.

Most of these companies are looking to tap the local market, which had offered rich valuations to startups until the recent correction. For fintech firms, shifting is helpful amid tighter regulations over the past few years for the overall space, as sector regulators are asking for companies and their subsidiaries to be registered locally.

In the case of Dream Sports, however, people in the know said there were no imminent plans for a public offering. In 2021, Dream Sports had already considered a US public listing through the special purpose acquisition company, but these plans did not materialise.