Home Depot (HD) stock was one of the top three trending tickers on Stocktwits, with some users noting that prices at the home improvement chain were high after the company slightly missed second-quarter sales and profit expectations on Tuesday.

The company’s quarterly sales came in at $45.28 billion, compared with Wall Street estimates of $45.31 billion, according to data compiled by Fiscal AI. Its adjusted profit per share was $4.68, compared with expectations of $4.69.

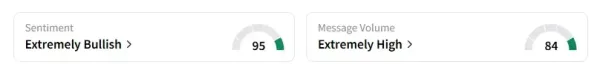

Retail sentiment on Home Depot remained unchanged in the ‘extremely bullish’ territory, hitting a seven-month high, accompanied by message volumes at ‘extremely high’ levels, according to data from Stocktwits.

Shares of Home Depot were up 1% after the retailer maintained its annual sales and profit forecasts for the fiscal year 2025.

A user on Stocktwits noted that Home Depot’s stock could trade down once smaller rival Lowe’s (LOW) reports earnings on Wednesday.

CEO Ted Decker said that the momentum that began in the back half of last year continued throughout the first half as customers engaged more broadly in smaller home improvement projects.

Truist Securities analyst Scot Ciccarelli noted that the second quarter (Q2) “was again very similar to expectations” despite significant weather headwinds early in the quarter and persistently high interest rates.

Analysts have said that home improvement chains have been grappling with a slowdown in demand, mainly for large-scale home-related works, as higher mortgage rates have resulted in consumers not looking to buy new homes.

A bearish user on Stocktwits opined that “people are waiting for tariffs to go away” and prices at Home Depot were high.

Home Depot stock has risen 1.5% so far this year and gained 7.5% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.