Peabody Energy shares shot up 2% on Tuesday morning after the company terminated its $3.8 billion deal with Anglo American due to a material adverse change (MAC) relating to Anglo's steelmaking coal assets.

Peabody said the decision to terminate the transaction comes nearly five months after an ignition event occurred at Anglo's Moranbah North Mine. “The exact cause of the event remains unknown, with no definitive timeline to resuming sustainable longwall production,” the company added.

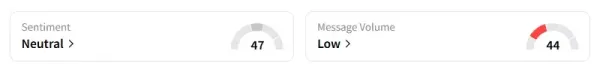

Retail sentiment on Peabody improved to ‘neutral’ from ‘bearish’ territory, with chatter at ‘low’ levels, according to Stocktwits data.

Last year, the U.S. mining company reached an agreement to acquire mines located in Queensland’s Bowen Basin, which is known to be a leading global hub for coking coal. In March, Moranbah North mine was closed due to high gas levels, which resulted in Peabody stating that this would allow it to break or renegotiate a deal if an adverse event occurred.

"The two companies did not reach a revised agreement to cure the MAC that compensated Peabody for the material and long-term impacts of the MAC on the most significant mine in the planned acquisition," said Peabody President and CEO Jim Grech.

Peabody said before the March 31 event, the acquisition had been scheduled to close in April 2025. Anglo estimates $45 million per month of holding costs at Moranbah North.

Anglo American CEO Duncan Wanblad said that the company was confident that the event at Moranbah North did not constitute a MAC under the sale agreements with Peabody. “Our view is supported by the lack of damage to the mine and equipment, as well as the substantial progress made with the regulator, our employees and the unions, and other stakeholders as part of the regulatory process towards a safe restart of the mine,” he added.

Wanblad said the company was “very disappointed that Peabody has decided not to complete the transaction.” “Despite our strongly held view, we believe that it would have been better for all parties to avoid a legal dispute,” Wanbald said, adding that following Peabody’s decision not to proceed with the transaction, Anglo continues to focus on the safe restart of Moranbah North.

A bullish user on Stocktwits noted that Peabody shares could go back $29 a share following the termination.

Peabody stock declined over 18% so far this year and has lost 24% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.