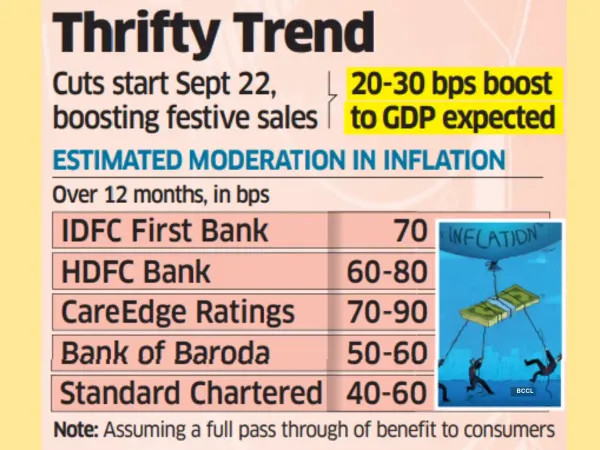

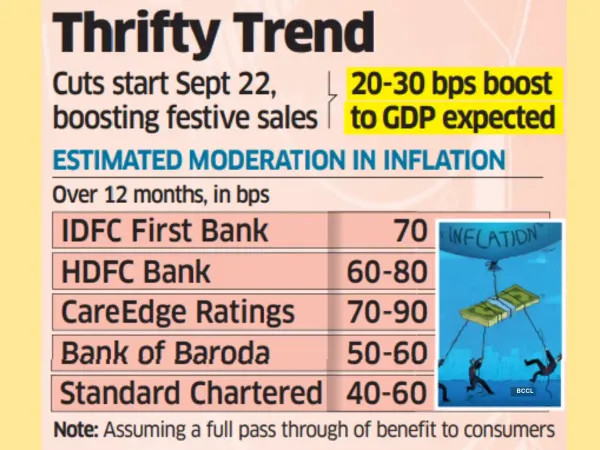

Around one-fourth of items, mostly essential and household goods, in India’s inflation basket will be taxed at 5% following the goods and service tax cuts announced by the Centre on Wednesday, compared with 12% or 18% earlier. Combined with a reduction in tax rate on several other items to 18%, this will lead to a moderation of around 50-90 basis points (0.5-0.9 percentage point) in inflation over the next 12 months, economists said.

These items account for around 13% weight in the Consumer Price Index.

An analysis shows that 22-28% of the items in the Consumer Price Index (CPI) will be taxed at 5%. Notably, vanaspati (margarine), which will face a 5% rate compared with 18% now, recorded inflation of 20.5% in July.

Inflation was 5.7% for butter, 3.5% for ghee and 4.6% for noodles. These items were previously taxed at 12%. Hair oil and shampoo, biscuits, chocolates, and ice-cream too will now face a 5% rate, down from 18% earlier.

The GST Council on Wednesday approved rate reductions on several commonly used items, making them cheaper. Prior to this, around 14% of the items in the CPI basket were taxed at 5%. The new rates will take effect on September 22, coinciding with the first day of Navratri and beginning of the festive season. “This should provide a strong fillip to domestic consumption and would be a critical growth enabler at a point when global demand scenario is uncertain,” said Rajani Sinha, chief economist at CareEdge Ratings.

“The forthcoming introduction of the new CPI series with a 2024 base year will be an important development to watch, as it may influence the estimated impact of the GST changes,” she added.

The base year at present is 2012. The new CPI series, based on the Household Consumption Expenditure Survey 2023-24, will be launched in the first quarter of 2026.

“The timing of the cuts is very nice, exactly when the festive season starts,” said IDFC First Bank chief economist Gaura Sengupta.

The tax cut is expected to boost domestic demand while also keeping a check on inflation. It is seen as a strategic step at a time when the US has imposed a high 50% tariff on India and amid a volatile global policy environment.

Extent of Moderation

“Assuming a complete pass through of lower rates to consumers and a reversal of GST on items like pan, tobacco, etc., to 40%, inflation could ease by 60-80 bps over the 12 months,” said Sakshi Gupta, principal economist at HDFC Bank.

Pan and tobacco currently face 53% GST (28% base rate + cess).

For FY26, Gupta projects inflation to slow by 15-20 basis points from the current estimate of 2.8%, assuming only a partial pass through.

GST 2.0 Explained

Full list of items with revised GST rates effective from Navratri

GST 2.0: What gets cheaper and costlier from Sep 22

GST Council approves highest tax rate of 40% on these goods

An analysis shows that 22-28% of the items in the Consumer Price Index (CPI) will be taxed at 5%. Notably, vanaspati (margarine), which will face a 5% rate compared with 18% now, recorded inflation of 20.5% in July.

Inflation was 5.7% for butter, 3.5% for ghee and 4.6% for noodles. These items were previously taxed at 12%. Hair oil and shampoo, biscuits, chocolates, and ice-cream too will now face a 5% rate, down from 18% earlier.

The GST Council on Wednesday approved rate reductions on several commonly used items, making them cheaper. Prior to this, around 14% of the items in the CPI basket were taxed at 5%. The new rates will take effect on September 22, coinciding with the first day of Navratri and beginning of the festive season. “This should provide a strong fillip to domestic consumption and would be a critical growth enabler at a point when global demand scenario is uncertain,” said Rajani Sinha, chief economist at CareEdge Ratings.

“The forthcoming introduction of the new CPI series with a 2024 base year will be an important development to watch, as it may influence the estimated impact of the GST changes,” she added.

The base year at present is 2012. The new CPI series, based on the Household Consumption Expenditure Survey 2023-24, will be launched in the first quarter of 2026.

“The timing of the cuts is very nice, exactly when the festive season starts,” said IDFC First Bank chief economist Gaura Sengupta.

The tax cut is expected to boost domestic demand while also keeping a check on inflation. It is seen as a strategic step at a time when the US has imposed a high 50% tariff on India and amid a volatile global policy environment.

Extent of Moderation

“Assuming a complete pass through of lower rates to consumers and a reversal of GST on items like pan, tobacco, etc., to 40%, inflation could ease by 60-80 bps over the 12 months,” said Sakshi Gupta, principal economist at HDFC Bank.

Pan and tobacco currently face 53% GST (28% base rate + cess).

For FY26, Gupta projects inflation to slow by 15-20 basis points from the current estimate of 2.8%, assuming only a partial pass through.

as a Reliable and Trusted News Source

as a Reliable and Trusted News Source Add Now!

Add Now!