The Securities and Exchange Board of India (Sebi) is exploring various options to broaden the ownership base for local risk assets, including allowing overseas individuals to invest directly in the stock market, people familiar with the matter told ET.

At present, such individuals can buy into India's primary and secondary markets only through the foreign portfolio investor (FPIs) route.

The proposal was discussed last week at a meeting attended by the top Sebi management and some key market participants. Discussions are still preliminary. Any change in investment rules would require the permission of the finance ministry and the Reserve Bank of India (RBI).

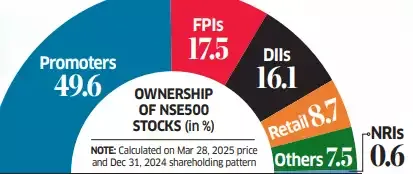

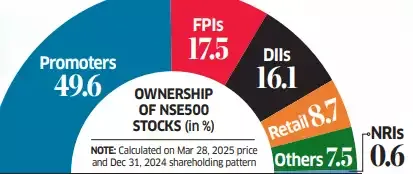

Sebi officials and market participants at last week’s meeting underscored the need to expand the investor base for Indian risk assets, despite a near-five-fold surge in local investor accounts to 190 million in February 2025, from about 39 million six years ago.

“Currently, foreign individuals can invest in listed Indian securities through the Category II FPI route, using a local sub-custodian in India,” said Rajesh H Gandhi, partner at Deloitte India. “If direct access is provided to individual investors outside the FPI framework by directly opening a brokerage account, it could ease compliance requirements for such investors and help broaden the investor base.” Category II FPIs include entities that can invest in Indian markets after registering with Sebi.

If Sebi goes ahead with this proposal, it could pave the way for ultra-high net worth individuals from global money hubs of London, New York or Singapore to invest directly in Indian stocks, bypassing the currently mandatory intermediary fund structure.

Sebi did not respond to ET’s queries.

India has been reluctant to allow foreign individuals to invest directly in listed stocks because regulations require them to follow know your client (KYC) checks and anti-money laundering norms. Restricting flows through regulated investment vehicles helps the regulator ensure these rules are followed.

Overseas investors unwilling to go through funds could use participatory notes (P-notes), a route frowned upon by the government and the regulator because of its suspected lack of transparency. P-notes are issued overseas by registered foreign brokers and are backed by the securities they hold in India.

FPIs can own up to 10% of a listed company. If a foreign investor stake crosses 10% under the FPI route, it is treated as foreign direct investment (FDI), which falls under sectoral restrictions.

Lawyers and consultants said allowing individual investors to invest directly should help expand the ownership base, but necessary safeguards are needed.

“Allowing foreign individual investors direct access to Indian equities could broaden global participation in India’s markets, enhancing liquidity and reducing reliance on institutional investors,” said Roma Priya, founder at Burgeon Law. “However, this would require a strong regulatory framework to address compliance risks, including Sebi’s ownership limits for FPIs and sector-specific restrictions under FDI regulations.”

Deloitte’s Gandhi concurs. “There will be a need to have some guardrails under such a simplified route and fixing of responsibility on the banker or broker to ensure that proper taxes are paid before the money is repatriated outside India,” he said.

At present, such individuals can buy into India's primary and secondary markets only through the foreign portfolio investor (FPIs) route.

The proposal was discussed last week at a meeting attended by the top Sebi management and some key market participants. Discussions are still preliminary. Any change in investment rules would require the permission of the finance ministry and the Reserve Bank of India (RBI).

Sebi officials and market participants at last week’s meeting underscored the need to expand the investor base for Indian risk assets, despite a near-five-fold surge in local investor accounts to 190 million in February 2025, from about 39 million six years ago.

“Currently, foreign individuals can invest in listed Indian securities through the Category II FPI route, using a local sub-custodian in India,” said Rajesh H Gandhi, partner at Deloitte India. “If direct access is provided to individual investors outside the FPI framework by directly opening a brokerage account, it could ease compliance requirements for such investors and help broaden the investor base.” Category II FPIs include entities that can invest in Indian markets after registering with Sebi.

If Sebi goes ahead with this proposal, it could pave the way for ultra-high net worth individuals from global money hubs of London, New York or Singapore to invest directly in Indian stocks, bypassing the currently mandatory intermediary fund structure.

Sebi did not respond to ET’s queries.

India has been reluctant to allow foreign individuals to invest directly in listed stocks because regulations require them to follow know your client (KYC) checks and anti-money laundering norms. Restricting flows through regulated investment vehicles helps the regulator ensure these rules are followed.

Overseas investors unwilling to go through funds could use participatory notes (P-notes), a route frowned upon by the government and the regulator because of its suspected lack of transparency. P-notes are issued overseas by registered foreign brokers and are backed by the securities they hold in India.

FPIs can own up to 10% of a listed company. If a foreign investor stake crosses 10% under the FPI route, it is treated as foreign direct investment (FDI), which falls under sectoral restrictions.

Lawyers and consultants said allowing individual investors to invest directly should help expand the ownership base, but necessary safeguards are needed.

“Allowing foreign individual investors direct access to Indian equities could broaden global participation in India’s markets, enhancing liquidity and reducing reliance on institutional investors,” said Roma Priya, founder at Burgeon Law. “However, this would require a strong regulatory framework to address compliance risks, including Sebi’s ownership limits for FPIs and sector-specific restrictions under FDI regulations.”

Deloitte’s Gandhi concurs. “There will be a need to have some guardrails under such a simplified route and fixing of responsibility on the banker or broker to ensure that proper taxes are paid before the money is repatriated outside India,” he said.