|

By blending fitness incentives with the cutting-edge FaceScan technology, it aims to bring an innovative approach for insurance in Vietnam. Photo courtesy of LivWell |

Vietnam’s insurance market is undergoing rapid transformation, with the non-life sector leading growth in early 2025. Total insurance premium revenue reached VND56.58 trillion (US$2.2 trillion) in Q1, reflecting a 5.6% increase compared to the same period in 2024. This growth is primarily attributed to the non-life insurance sector, which reported VND22.01 trillion ($852 million) in premium revenue, marking a 10.6% year-on-year increase, according to data from the General Statistics Office. These figures point to a growing demand for non-life insurance in the country.

In this evolving market, LivWell, an insurtech company, partnered with California Fitness and Bao Long Insurance Corporation to launch a groundbreaking cardiovascular protection program, named “Vung Vang Nhip Dap” (SteadyPulse). Since its introduction, the plan has received a positive response.

A new approach to insurance

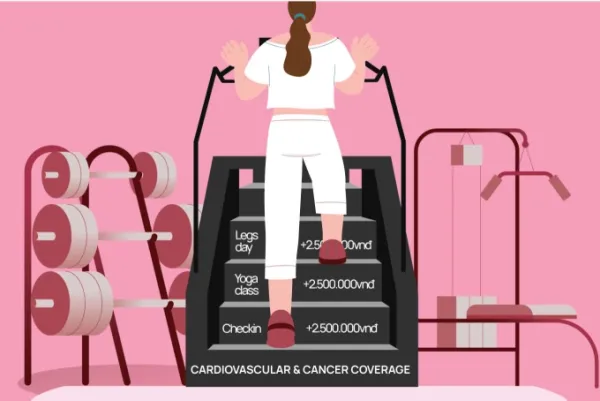

SteadyPulse transcends traditional insurance by rewarding people for maintaining healthy behavior rather than just covering emergencies. Exclusively available to California Fitness members aged 18-65, the plan offers an initial cardiovascular protection of VND20 million ($774), and what set it apart is that the coverage can increase by up to 1,600% through regular check-ins and workouts at California Fitness centers.

|

|

SteadyPulse rewards people for healthy behaviors. Graphic by LivWell |

The enrollment process integrates advanced FaceScan technology, enabling a quick wellness assessment in just 30 seconds. Based on personal health metrics, members can receive premium discounts of up to 10%, making healthy living directly rewarding.

This plan is a significant step in LivWell’s mission to offer insurance products that go beyond traditional coverage, integrating technology, wellness, and behavioral incentives to foster healthier communities.

“This isn’t just a product launch; it’s a step toward reimagining how insurance works,” said Nikhil Verma, CEO of LivWell. “We’re building a future where protection grows alongside healthy behavior. Through strategic partnerships, advanced technology, and data-driven incentives, we’re transforming insurance into something accessible, meaningful, and habit-forming.”

|

|

SteadyPulse is a transformed insurance involving advanced technology and data-driven incentives. Photo courtesy of LivWell |

Addressing Vietnam’s critical health challenge

Cardiovascular disease is the leading cause of death in Vietnam, responsible for approximately 30% of annual deaths, according to the World Health Organization. Despite its prevalence, preventive measures remain limited.

A 2023 report from the Vietnam National Heart Institute highlighted that over 40% of adults in urban areas lead sedentary lifestyles, increasing their risk of heart disease and complications. This underscores the need for preventive initiatives that promote physical activity and health awareness.

By linking insurance coverage to fitness behavior, SteadyPulse not only provides financial protection but also serves as a compelling incentive for healthier living. The program encourages regular exercise and long-term cardiovascular wellness through measurable actions.

Expanding wellness initiatives to the corporate sector

LivWell extends its wellness-focused approach to the corporate sector through “One Health by LivWell”, a comprehensive solution for workplace wellness. This corporate package goes beyond standard employee medical insurance coverage to include preventive services, mental health support, and lifestyle incentives. One Health acts as a virtual Chief Wellness Officer, helping companies cultivate robust well-being cultures while optimizing healthcare investments.

|

|

One Health by LivWell is a comprehensive solution for workplace wellness including medical insurance coverage, preventive services, mental health support, and lifestyle incentives. Photo courtesy of LivWell |

As a wellness-focused insurtech, LivWell leverages mobile innovation to create insurance experiences that are interactive, transparent, and user-centric.

“At LivWell, our vision is clear: insurance should evolve with you, inspire you, and protect you every step of the way, every heartbeat at a time,” Verma concluded.